Filing your 2014 Tax Return

Have you filed your 2014 tax return? If not, you’ll want to make sure that you understand the requirements for reporting your health care coverage or your exemption status, or for making an individual shared responsibility payment with your tax return. The IRS has released Publication 5209 (http://www.irs.gov/pub/irs-pdf/p5209.pdf), a guide for helping individuals understand and comply with these requirements, which is summarized below. Your tax accountant or tax software should also be able to guide you through the process.

Have you filed your 2014 tax return? If not, you’ll want to make sure that you understand the requirements for reporting your health care coverage or your exemption status, or for making an individual shared responsibility payment with your tax return. The IRS has released Publication 5209 (http://www.irs.gov/pub/irs-pdf/p5209.pdf), a guide for helping individuals understand and comply with these requirements, which is summarized below. Your tax accountant or tax software should also be able to guide you through the process.

Reporting your Coverage

Most people had qualifying health care coverage in 2014 and will simply check a box to report that coverage on their federal tax return when they file in 2015. Others may qualify for an exemption from the requirement to maintain coverage. To learn more about minimum coverage requirements, click here: http://www.irs.gov/Affordable-Care-Act/Individuals-and-Families/ACA-Individual-Shared-Responsibility-Provision-Minimum-Essential-Coverage. However, beginning with your 2014 income tax return, if you or any of your dependents did not have qualifying health care coverage and did not qualify for an exemption from the requirement to maintain coverage, you will need to make an individual shared responsibility payment with your income tax return. The IRS has an interactive online tool to help you figure out whether you need to make an individual shared responsibility payment. To access the tool, click here: http://www.irs.gov/uac/Am-I-required-to-make-an-Individual-Shared-Responsibility-Payment%3F.

Figuring your Payment

You can figure your shared responsibility payment using the worksheet included in the instructions for IRS Form 8965, Health Coverage Exemptions. To view or download these instructions, click here: http://www.irs.gov/pub/irs-pdf/i8965.pdf. Tax preparation software can also help you calculate your payment when filing electronically.

Payment Limits

Typically, the payment amount is either a percentage of your household income or a flat dollar amount, whichever is greater. The annual payment amount for 2014 is the greater of:

- 1 percent of your household income that is above the tax return filing threshold for your filing status, such as married filing jointly or single, or

- Your family’s flat dollar amount, which is $95 per adult and $47.50 per child under 18, limited to a maximum of $285.

However, your payment is capped at the amount of the national average premium for bronze level health plans available through the Health Insurance Marketplace. For 2014, that amount per individual is $2,448, which equals $204 per month. The maximum payment for a family with five or more members is $12,240, which equals $1,020 per month.

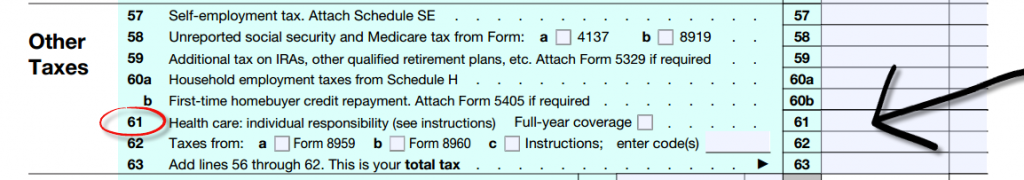

Reporting the Payment

- Enter your payment amount on line 61 of Form 1040, line 38 of Form 1040A or line 11 of Form 1040EZ

- Your payment amount will either reduce the amount of your refund or increase the amount you owe.

- If you cannot afford to make your payment at the time you file your tax return, the IRS has a number of ways to work with you including IRS Direct Pay (http://www.irs.gov/Payments/Make-a-Payment) and online payment agreements (http://www.irs.gov/Individuals/Online-Payment-Agreement-Application).